CA DE-154 GC-035 1998-2025 free printable template

Show details

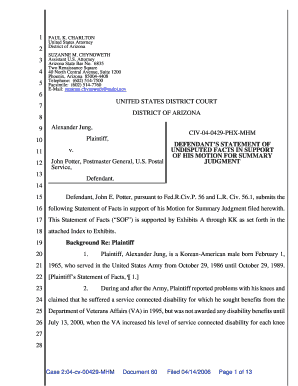

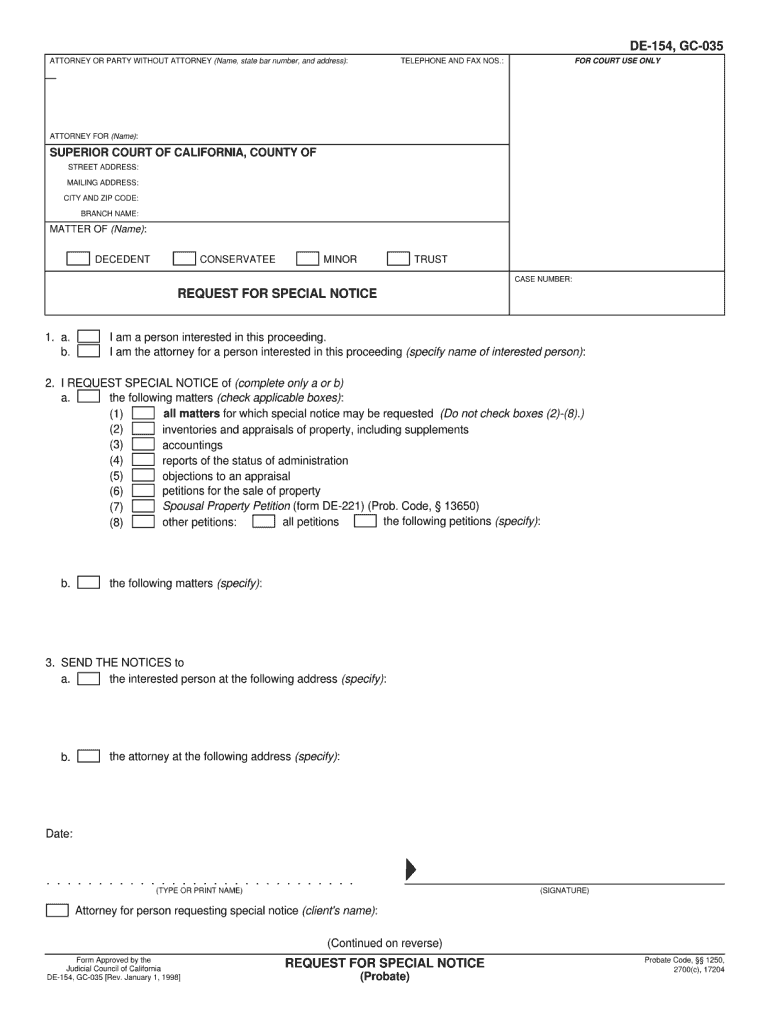

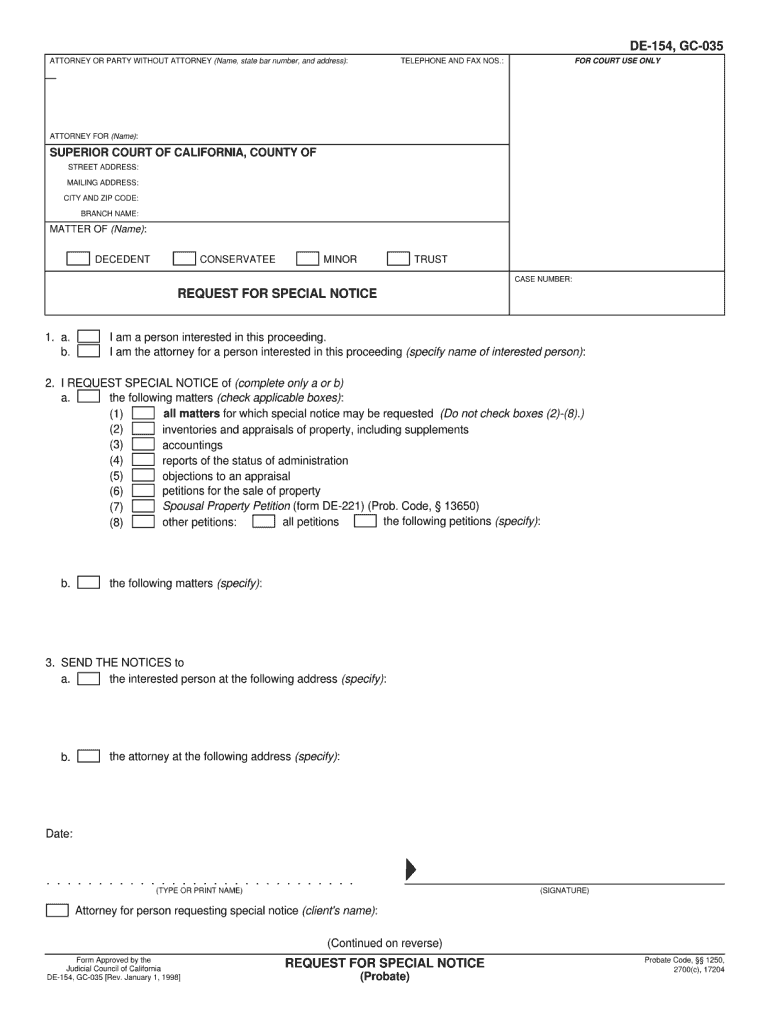

I REQUEST SPECIAL NOTICE of complete only a or b a. the following matters check applicable boxes all matters for which special notice may be requested Do not check boxes 2 - 8. ADMISSION OF SERVICE 1. I am the personal representative conservator guardian or trustee 2. I ACKNOWLEDGE that I was served a copy of the foregoing Request for Special Notice. TYPE OR PRINT NAME SIGNATURE Attorney for person requesting special notice client s name Continued on reverse Form Approved by the Judicial...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign request for special notice probate form

Edit your obtain a blank ca de 154 gc 035 form from contact information of the person completing the form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de154 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 154 01 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca 154 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cdcr form 154

How to fill out CA DE-154 GC-035

01

Obtain a blank CA DE-154 GC-035 form from the California Judicial Council website or your local courthouse.

02

Fill in the case number at the top of the form.

03

Enter the name and contact information of the person completing the form.

04

Include the title of the case (e.g., 'In re the Marriage of...') below the case number.

05

List the names of all parties involved in the case in the appropriate fields.

06

Fill out the 'Notice to Interested Parties' section as required.

07

Sign and date the form at the bottom.

08

Make copies of the completed form for your records and for the other parties involved.

09

File the completed CA DE-154 GC-035 form with the court as instructed.

Who needs CA DE-154 GC-035?

01

Individuals involved in a legal matter that requires serving notices to interested parties.

02

Legal representatives or attorneys handling cases that necessitate the use of this form.

03

Persons seeking to appoint a guardian or conservator in legal proceedings.

Fill

request for special notice

: Try Risk Free

People Also Ask about

What is a Letter of representation for a deceased person?

A Letter of Testamentary—sometimes called a "Letter of Administration" or "Letter of Representation"—is a document granted by a local court. The document simply states that you are the legal executor for a particular estate and that you have the ability to act as such.

What happens if you don't file probate in California?

The estate will be frozen and inaccessible to the beneficiaries: This consequence is inevitable, as property and assets cannot be transferred without going through probate first. This is because the court needs to ensure that all debts and taxes are paid off before the estate can be distributed.

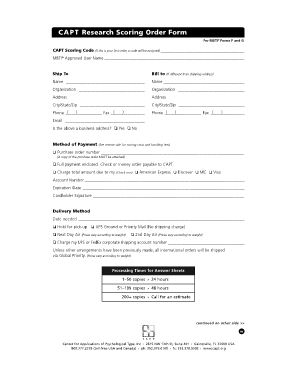

What is Form DE 154?

DE-154 REQUEST FOR SPECIAL NOTICE (Probate)

What forms do I need to file probate in California?

Step 1 Petition for Probate (Form DE-111, Judicial Council), and all attachments, Original Will (if there is one) Notice of Petition to Administer Estate (Form DE-121, Judicial Council) Duties and Liabilities of Personal Representative (Form DE-147, Judicial Council) Order for Probate (Form DE-140, Judicial Council)

What does request for special notice mean?

In this video, I'm going to cover the Request for Special Notice. This is a filing that you can do in a probate action and it will help ensure that you get noticed in everything that occurs in that probate action.

What is a DE 150 form?

Persons who are appointed as personal representatives of estates use this to prove to others that they need to work with to carry out their duties that they have been officially appointed by the court.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA DE-154 GC-035 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including CA DE-154 GC-035. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send CA DE-154 GC-035 to be eSigned by others?

When your CA DE-154 GC-035 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit CA DE-154 GC-035 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing CA DE-154 GC-035, you need to install and log in to the app.

What is CA DE-154 GC-035?

CA DE-154 GC-035 is a form used in the California court system related to the administration of estates, specifically concerning the accounting of a guardian or conservator.

Who is required to file CA DE-154 GC-035?

Guardians or conservators who are managing the affairs of a minor or an incapacitated individual are required to file CA DE-154 GC-035.

How to fill out CA DE-154 GC-035?

To fill out CA DE-154 GC-035, you need to provide detailed information regarding financial transactions, including income, expenses, assets, and liabilities, followed by a summary of the overall financial situation.

What is the purpose of CA DE-154 GC-035?

The purpose of CA DE-154 GC-035 is to provide the court with a comprehensive accounting of the financial activities of the guardian or conservator, ensuring transparency and proper management of the estate.

What information must be reported on CA DE-154 GC-035?

Information that must be reported includes the guardian's or conservator's name, details of the ward's assets, liabilities, income, expenses, and any transactions made on behalf of the ward.

Fill out your CA DE-154 GC-035 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE-154 GC-035 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.